Change From The Close

Table of Contents

- Understanding the Change from Close Dollar Filter

- Change from Close Dollar Filter Settings

- Using the Change from Close Dollar Filter

- FAQs

Understanding the Change from Close Dollar Filter

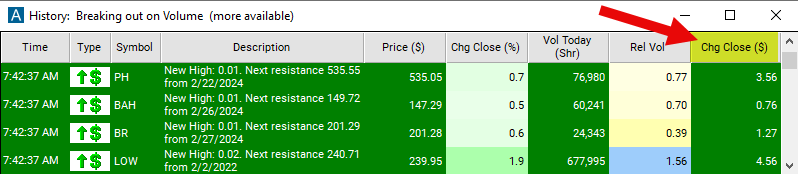

The "change from close ($)" filter refers to the difference between the current price of a stock and its closing price from the previous trading session, measured in dollars. This filter provides traders with information about how much the stock price has moved since the previous close. Positive numbers represent stocks which are trading higher now than at the close. Use negative numbers for stocks which are trading lower than at the close.

These filters are related to the % up / down for the day alerts. The filters and the alerts both compare the current price to the previous close. However, there are some differences:

- The alerts typically only display once for each level. The filters always have a value.

- The alerts only work with percentage values.

- The alerts only work during normal market hours.

Change from Close Dollar Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the min value to 0.75 to see only stocks which are trading at least 75 cents above where they were at the previous close.

Using the Change from Close Dollar Filter

Several trading strategies can be employed with the Change from Close Dollar filter. Here are a few examples:

Momentum Trading: Momentum traders aim to capitalize on the continuation of an existing trend in the stock's price. Traders may look for stocks with a significant positive change from the previous close, indicating upward momentum. They may then buy the stock, expecting the price to continue moving higher. Conversely, if a stock has a significant negative change from the previous close, indicating downward momentum, traders may consider short-selling the stock.

Breakout Trading: Breakout traders aim to capitalize on significant price movements that break through key support or resistance levels. Traders may monitor stocks with a large change from the previous close, particularly if the change results in the stock breaking through a significant support or resistance level. They may then enter trades in the direction of the breakout, anticipating further price movement in that direction.

Reversal Trading: Reversal traders aim to identify points where a stock's price is likely to reverse direction. Traders may look for stocks with an extreme change from the previous close, indicating potential overextension in price. If a stock has experienced a large positive change from the previous close, traders may anticipate a reversal and consider short-selling the stock. Conversely, if a stock has experienced a large negative change from the previous close, traders may anticipate a reversal and consider buying the stock.

FAQs

Why is the "change from close ($)" filter important in trading?

- The "change from close ($)" filter provides traders with valuable information about recent price movements in a stock. It helps traders gauge the magnitude of price changes and identify potential trading opportunities based on these movements.

How is the "change from close ($)" calculated?

- The "change from close ($)" is calculated by subtracting the previous closing price of the stock from its current price. The result represents the dollar amount by which the stock price has changed since the previous close.

How frequently should traders monitor the "change from close ($)" filter?

- The frequency of monitoring the "change from close ($)" filter depends on individual trading preferences and strategies. Some traders may monitor it continuously throughout the trading day, while others may check it periodically, such as at key market events or during significant price movements.

Filter Info for Change From The Close [FCD]

- description = Change from the Close

- keywords = Single Print

- units = $

- format = p

- toplistable = 1

- parent_code =

Change from the Close [FCP]

Change from the Close [FCP] Change from the Close [FCR]

Change from the Close [FCR]