Truth behind Overbought and Oversold?

Truth behind Overbought and Oversold?

Written by Katie Gomez

Young or new traders often need help distinguishing what or what not to believe about the market. Just because something is a common saying does not mean it is a valid argument. In a previous article, I reviewed the origin of the saying “sell in May and go away” and found more truth behind it than I once thought. Therefore, I will now conduct a similar dissection of “overbought” and “oversold.” Should new traders blindly follow the path these phrases create, or should they proceed cautiously?

What is the meaning behind Overbought and Oversold?

An overbought stock is a stock that has experienced a significant increase in a stock’s price over a short period, leading to a skewed evaluation, where it ends up trading at a level above its true or fair value. Usually caused by a flood of positive feedback, news sources push the narrative behind the stock company, highlighting its potential growth, leading to traders flocking like seagulls over to it due to a fear of missing out. As a result, these trending stocks are bought rather aggressively for short periods until the market eventually corrects itself and its price falls back to intrinsic value (Vaidya, 2023). An overbought stock eventually calls for a price correction if it rises too quickly without the support of the company’s fundamentals.

Overbought stocks can be identified using technical analysis indicators such as the Relative Strength Index (RSI) to measure the stock’s momentum in price movement. Indicators such as RSI help indicate whether or not a stock resides in or is entering overbought territory.

Timing trades right is crucial because a correction can occur whenever investors begin to sell off their shares, causing the price to fall. Therefore, we must remain cautious when choosing to invest in overbought stocks by conducting our own thorough research to ensure that the company’s underlying fundamentals support the stock’s price.

On the other hand, oversold stocks are stocks that have experienced a considerable decrease in price over a short period, leading the stock to trade below its true value. In addition to overbought stocks, RSI is also helpful in identifying the oversold.

Unfortunately, many traders tend to oversimplify this process by assuming that overbought stocks are a selling opportunity while oversold stocks are a buying opportunity. However, wise and more experienced traders know better than to assume anything and avoid jumping at an opportunity without doing their due diligence.

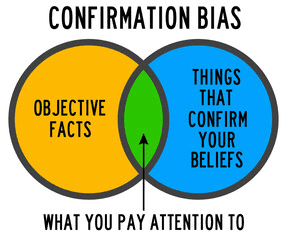

One of the worst things a trader can do is assume or expect correlation to equal causation, for in the market, things are never as they seem. Michael Nauss, one of our experienced traders at Trade Ideas, recently discussed this idea in one of his recent substack posts. Nauss believes that overbought and oversold is a myth, claiming that the entire premise is built upon psychological distortion. Like many theories, confirmation bias plays a role in the results we see, as well as a follow-the-herd mentality. For example, it’s common for new traders to see an oversold stock as a hot commodity and immediately run to get in on the action.

So if trading overbought or oversold should not be trusted to outperform the market in the long run, what can we rely on? Simply put, math. Nauss explains that the basic formula of RSI is still beneficial to find averages on your own and move away from where the herd is running. In other words, try directing your energy toward looking for stocks where RSI cannot get oversold for a long time (Nauss, 2023).

After obtaining the bullish and bearish ranges provided by the RSI, you are better equipped to see the best decisions for your trades, long term, instead of being blinded by the shiny oversold stock being thrown in your face by the public. Once we better understand the RSI and its purpose, we can see that overbought/oversold are not signals that indicate price turns but merely markers to look out for. So don’t let misinformation distract you; relinquish your attention to detail.

References

https://michaelnausscmt.substack.com/p/you-are-using-rsi-wrong