Traders Eye With Andy

Traders Eye With Andy

Hello, traders! It’s Andy from Trade Ideas bringing you another post full of market insights. This time, we’re diving into the events and trends of October 11, a lively Wednesday for the trading world.

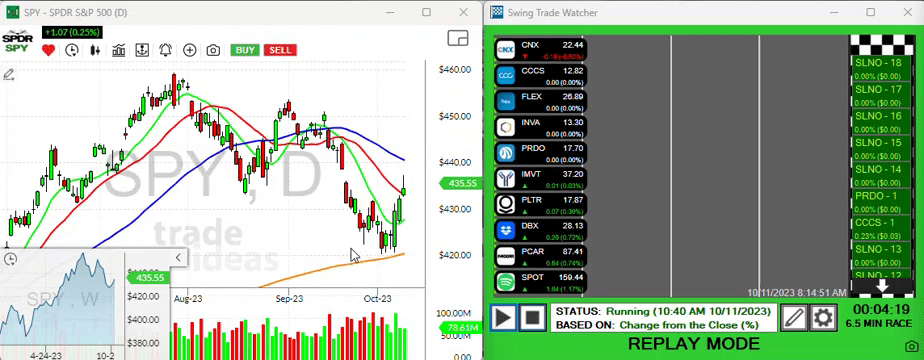

A Brief Overview: SPY and The Bigger Picture

While we are experiencing a pleasant three-day period, it’s safe to say we are still somewhat in the wilderness. Our trusted friend, the SPY, is at present in a no-man’s-land state. Could we be waiting for our next move, or just the calm before the storm?

We’ve noticed a slight upward gap but topped with uncertainty. Talk around the water cooler suggests a potential push to fill the gap, even testing out the 50 period moving average. However, the future likely holds more upside than downside despite the unclear path.

“We’re kind of in no man’s land right here, so we’ll see what happens.“

Stocks to Watch: A Closer Look

As we navigate our way out of the unpredictable plains, here are some stocks that are worth your attention and could prove advantageous.

Akamai

This brand has stuck around my list for a good while now, remaining consistent with its impressive moves. With decent volume supporting it, it appears as if it’s gapping up again in this morning’s trading hours. As I’ve been keeping a close eye on this one, my price alert is due to fire off soon, indicating a prominent breakout on the horizon. Although it does have a gap to fill, I won’t delve into pulling back the chart this time; just know Akamai demands our watchful eye today.

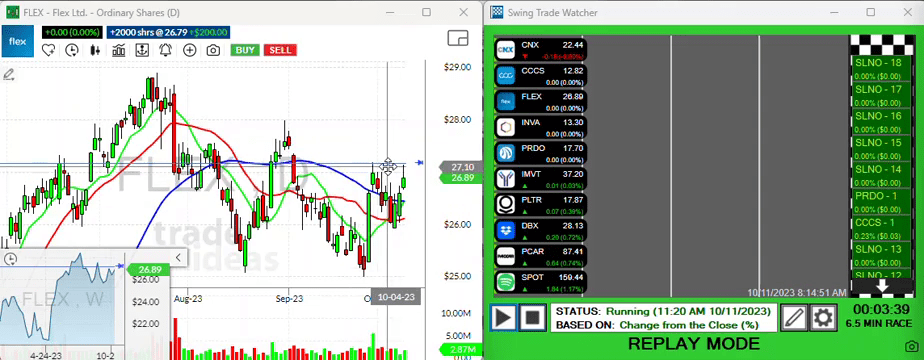

Flex

I’m currently active in this stock, having bought it two days ago. Noticing the potential for a breakout if it manages to take out the ten-day high point, thus grabbing some promising momentum. Keep this one under your radar!

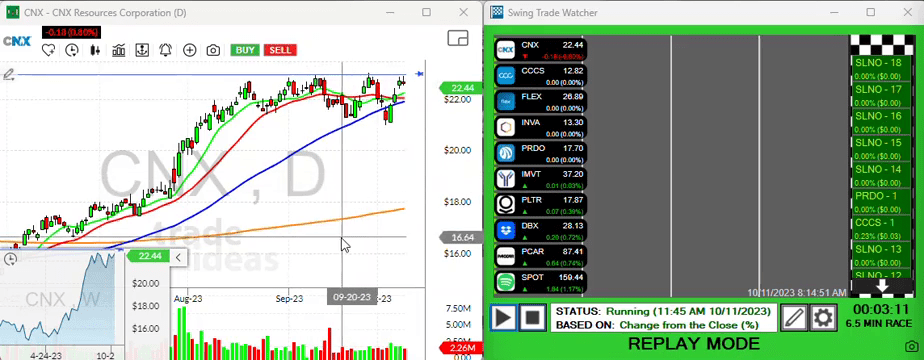

CNX

I’m usually not the biggest advocate for playing oil stocks – too similar to the unpredictability of gold stocks with their habit for gap downs and unexpected gap ups. But the chart for CNX takes the cake. It’s got a solid resistance level that, if broken through, promises a strong momentum surge behind the move.

Dropbox

Following closely behind our aforementioned stocks is Dropbox, as its resistance level matches up well with that of CNX. Any successful breach here assures an explosive move, echoing sentiments around CNX.

VIPs China Play

Veering into international terrain, here is a swift one from the East. Although not illustrious on the chart, there’s been a substantial amount of call option buying as of late. If the stock manages to vault the two-month high, it could usher in a swift and profitable rally. Also, be aware of the gap fill hovering around the 1750 level.

That’s all for today. Stay alert and tuned in. As we wrap up the day, the takeaway is to remember the ebb and flow of the markets and that patience and vigilance are a trader’s best friends. See you tomorrow!

“All right, that’s it for today. Have a good one and we’ll talk to you tomorrow. Bye.“

.