Avoid Emotional Trading: Profit and Loss Window

Avoid Emotional Trading: Profit and Loss Window

Written by Steve Gomez

Trading is a mixture of strategies, technical skill, market understanding, and overcoming human error. In this industry, emotions are your nemesis—they can make you abandon your plan, make hasty decisions, and leave trades prematurely. The profit and loss (P&L) window, though crucial, can sometimes become a trigger for these emotions. However, it can be effectively managed to avoid an emotionally-driven trade. Let’s delve into exploring strategies on how you can do this.

Understanding Emotions and Trading

Before we dive into the role of the P&L window, it’s vital to discuss how emotions can disrupt trading. When we talk about trading, we often discuss strategy, precision, and quick decisions. But we don’t often mention the impact of emotion on these decisions.

It’s quite common to experience fear or greed while trading. Fear can lead you to exit a profitable trade too soon, while greed can push you to stay for longer than you should, hoping for more profit. These emotions can distract you from your established strategy and lead to costly mistakes.

The Profit & Loss Window: A Double-Edged Sword

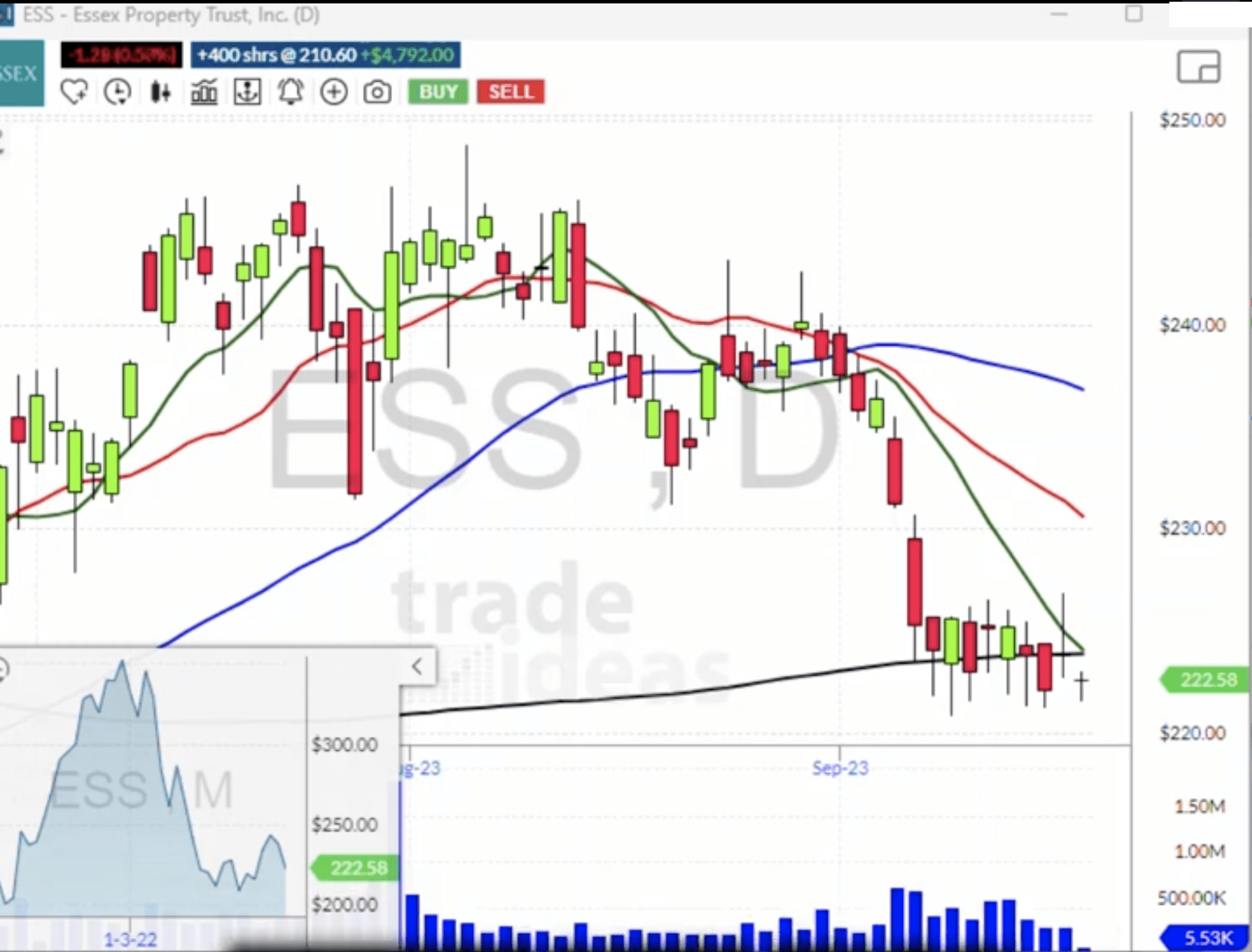

A P&L window is a trading platform feature that shows the unrealized and realized income from a trader’s closed and open positions. While it offers useful insight into your trading performance, it can sometimes cause emotional triggers.

If you’re looking at a P&L window and see your trade down by a substantial amount, it can cause panic, leading to a real disaster—abandoning your plan and making impulsive decisions based on a fleeting view of a trade’s performance.

Taming the Emotion Trigger: The Solution

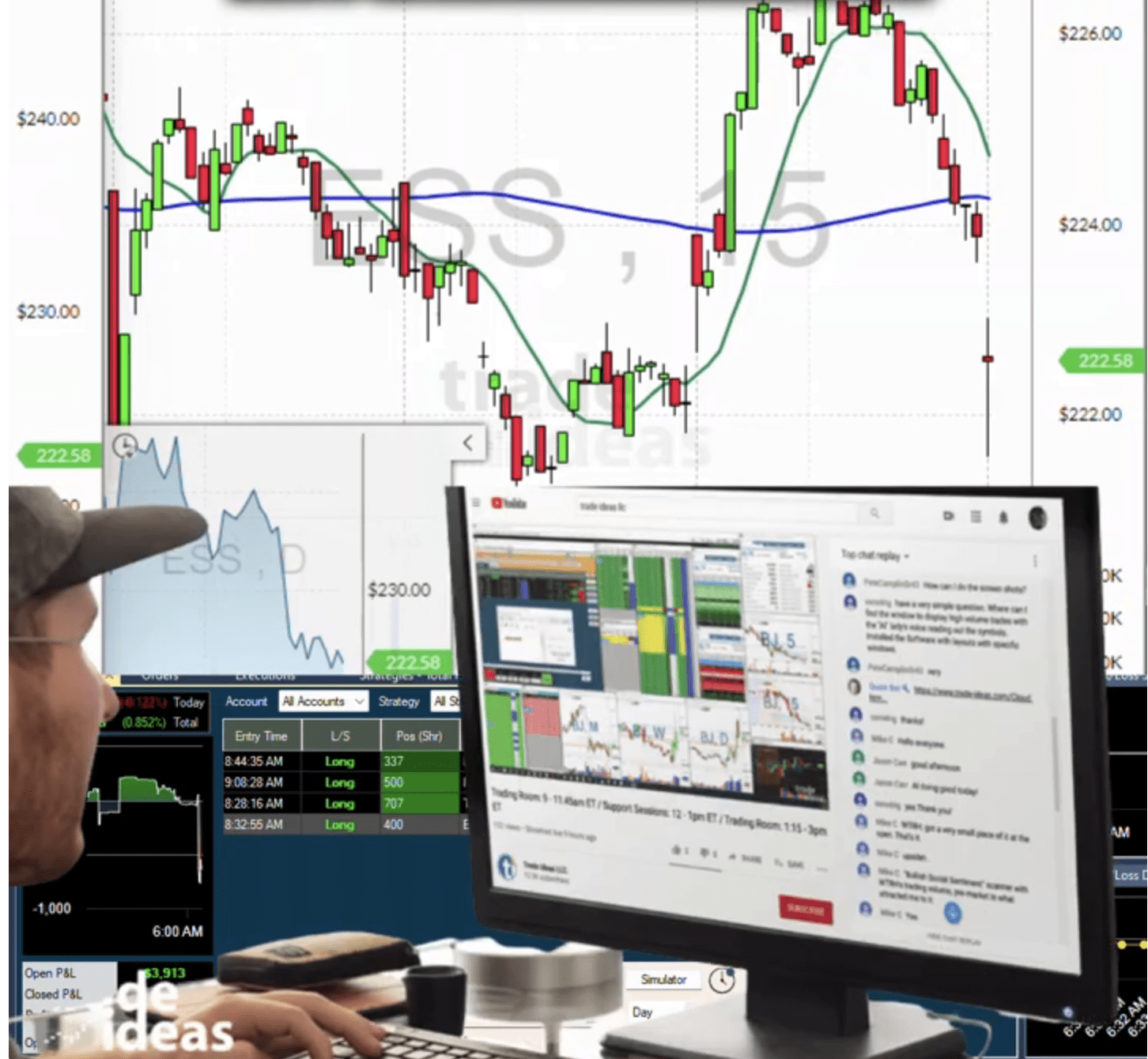

Surprisingly, the solution to avoiding this emotional rollercoaster is quite simple: Turn off the P&L window. That’s right, you have the ability to close this window and choose not to look at it.

This might seem counterproductive. After all, isn’t it important to know your trade’s status? Yet, that’s where focusing on the charts comes in.

Chart Analysis over Emotion-driven Decisions

Instead of relying solely on your P&L window, focusing on chart analysis offers a more strategic approach to making trade decisions. Although the P&L window shows how much money you’re losing or gaining at any moment, it doesn’t show the full story of what’s happening in the market.

By focusing on the charts, you keep your attention on the market’s technical aspects, helping you stick to your original trade plan and minimizing the potential impact of emotions. You know where your levels are—resistance or support—and make your decisions based on movements within those lines.

In summary, the P&L window can be a useful tool, but don’t let it drive your trade decisions. Use it as a supplementary tool alongside other technical tools, and most importantly, don’t let your emotions get in the way of your trading playbook. Remember, practice makes perfect, so continue honing these strategies to become a better, more disciplined trader.